flow through entity taxation

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. 560-7-8-34 contains extremely useful guidance on a number of critical issues not merely in the area of withholding but the taxation of flow through entities generally such as the application of apportionment and allocation principles to flow through entities generally.

What You Need To Know About Single Llc Taxes And A Disregarded Entity

Since the Tax Cuts and Jobs Act of 2017 TCJA limited an individuals state and local tax SALT deduction to 10000 states have been exploring pass-through entity tax workarounds in response.

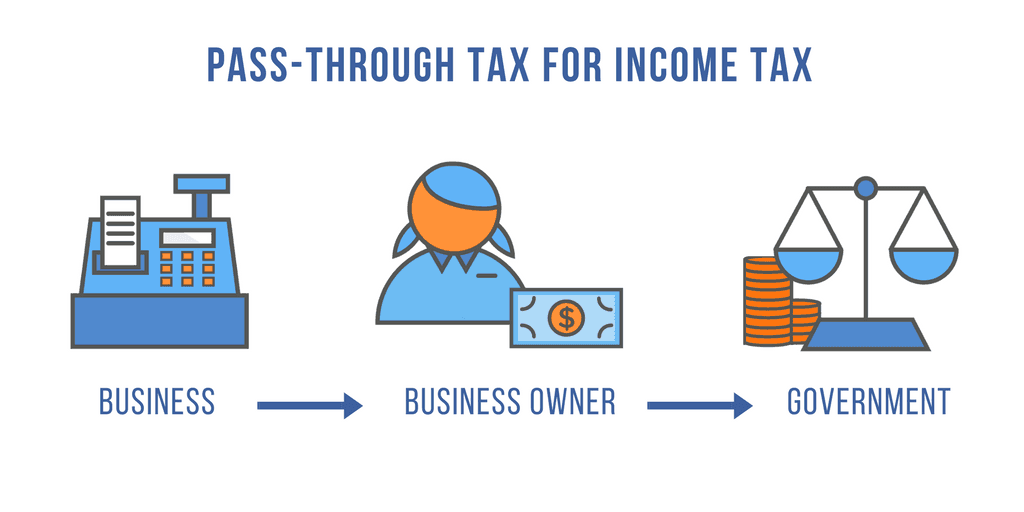

. This means that the flow-through entity is responsible for the taxes and does not itself pay them. Tax professionals who work with individuals small businesses and large corporations must understand the laws and regulations associated with flow-through entities to protect their clients revenue. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a corporate tax code.

A flow-through entity is a legal entity where income flows through to investors or owners. A flow-through entity is also called a pass-through entity. Follow the links below for more information on these topics.

Up to 10 cash back Example Question 3. A legitimate business entity that passes income to owners or investors of the business is a flow-Through entity. Flow-through entities are used for several reasons including tax advantages.

What is a Flow-Through Entity. Flow-through businesses include sole proprietorships partnerships and S. Flow-through entities are a common legal business entity designation that protects business owners from double taxation.

Californias pass-through entity tax election. 01 April 2021. The regulation which appears as Reg.

Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. Limited liability companies LLCs that file federal income tax returns as partnerships.

Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Fast forward to November 2020 when the IRS gave guidance to allow state tax deductions at the pass-through entity level and opened the floodgates to. Regulations continue to change the thresholds and treatment of both revenue and expenses for many organizations.

Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate. Partnerships including limited partnerships limited liability partnerships and general partnerships. This requires many business owners and members of flow.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based on the.

In addition to LLCs sole proprietorships S Corporations and partnerships are all pass-through businesses. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital gain you reported created an exempt capital gains balance ECGB for that entity. Cash of 50000 Equipment with a FMV of 35000 and Carrying amount of 25000.

That is the income of the entity is treated as the income of the investors or owners. The majority of businesses are pass-through entities. As well as links to websites and other resources of interest to the flow-through entities tax community.

The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. The following types of common flow-through entities may elect to pay the Michigan FTE tax. Flow-through entities are different from C corporations they are subjected to single taxation.

A pass-through entity also called a flow-through entity is a type of business structure used to avoid double taxation. Understanding What a Flow-Through Entity Is. In the end the purpose of flow-through entities is the same as that.

Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Every profit-making business other than a C corporation is a flow-through. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs.

Flow-through entities are considered to be pass-through entities. Taxation Of Flow Through Entities Andrew contributed the following assets to a partnership in exchange for a 50 interest in the partnerships capital and profits. Common Types of Pass-Through Entities.

Typically businesses are subject to corporate tax while business owners also have to pay a personal income tax. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

For more information on the sale of this type of property see Disposing of your shares of or. Strategic tax services for pass-through businesses and partnerships. The benefits and tax obligations of operating flow-through entities and pass-through businesses are more complex than ever.

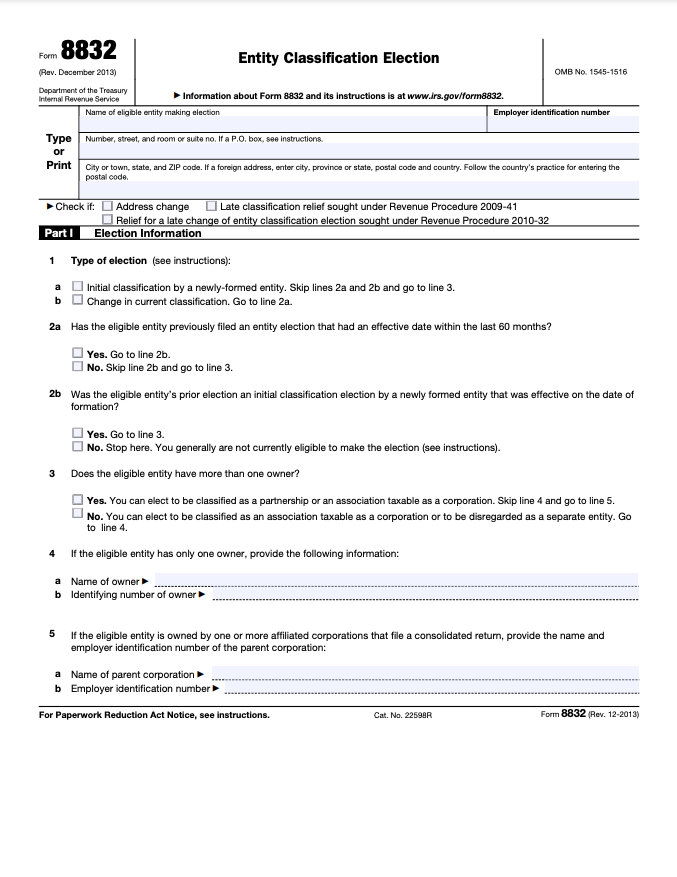

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Pass Through Taxation What Small Business Owners Need To Know

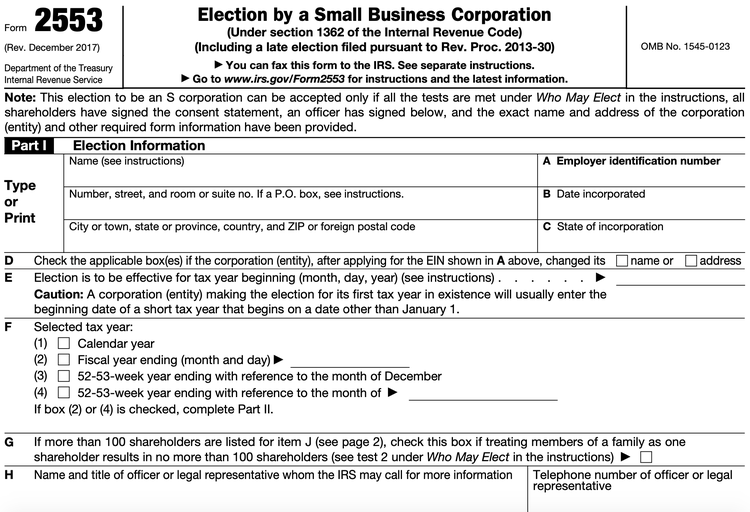

Converting From C To S Corp May Be Costlier Than You Think

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

Pass Through Entity Definition Examples Advantages Disadvantages

Flow Through Entity Overview Types Advantages

Business Entity Comparison Harbor Compliance

What You Need To Know About Single Llc Taxes And A Disregarded Entity

Dpdf19 Bizfilings 5 Steps To Forming Entity Infographic Business Owner Infographic Operations Management

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

A Beginner S Guide To Pass Through Entities

Filing Personal And Business Taxes Separately A Small Business Guide

How To Choose Your Llc Tax Status Truic

Pass Through Entity Tax 101 Baker Tilly

Choice Of Entity Choosing The Right Business Structure

What Is A Disregarded Entity And How Does It Affect Your Taxes

How To Choose Your Llc Tax Status Truic

Hybrid Entities And Reverse Hybrid Entities International Tax Blog